Image via Wikipedia

Image via Wikipedia

-----------------------------------

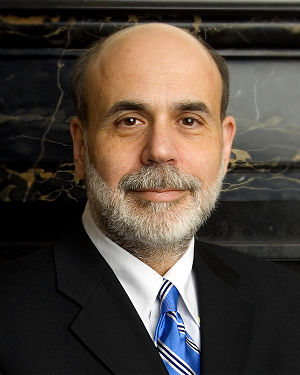

WASHINGTON - US Federal Reserve chief Ben Bernanke (picture) is expected to shed light this week on the central bank's sudden decision to hike an emergency bank-lending rate, triggering speculation on monetary tightening.

Mr Bernanke is scheduled to appear before the financial committee of the House of Representatives on Wednesday and the Senate banking panel the next day, where his testimony will be closely scrutinised by jittery markets.

The Fed's increase on Friday of the discount rate, the interest it charges on emergency loans to banks, rattled stock markets. Investors feared the central bank might be moving faster than anticipated to withdraw critical support measures for the US economy, as it recovered from a brutal recession.

It was the first major action by the Fed to remove some of the unprecedented monetary easing measures; and also the first tinkering of interest rates by a central bank from the Group of Seven industrialised nations after emerging from recession, analysts said.

The markets were particularly concerned that the central bank was setting the stage for tightening the more significant federal funds rate, the benchmark interest rate that banks charge each other for loans now at virtually zero per cent.

"Hopefully, chairman Ben Bernanke's testimony to Congress (this) week will shed some important new light on the Fed's policy intentions," said Mr Brian Bethune, chief US financial economist of IHS Global Insight.

"It is indeed puzzling as to why the Fed made this move and announcement out of cycle with its meeting dates for 2010."

Although many had expected the Fed to raise the discount rate, considering the waning interest from banks for the short-term loan facility, the timing caught many by surprise, especially coming well ahead of the central bank's March 16 policy meeting.

If the Fed was laying the groundwork for dismantling the easy money policy critical to accelerating the US recovery, it appeared premature, analysts said.

The US economy expanded by a strong 5.7 per cent in the final 2009 quarter after 2.2 per cent growth in the preceding quarter, but unemployment near double digits is expected to persist for some time in the face of lagging job growth.

In addition, the latest consumer price data for January showed tame inflation, underscoring weak demand and still-fragile recovery from a recession that began in December 2007 and has cost more than seven million jobs.

"In some ways the timing of the Fed move is peculiar since growth is not exactly building in a clear way," said Mr Robert Brusca, chief economist at FAO Economics.

The economy "has been so weak for so long that if there is backsliding the possibility that economic weakness turns to financial catastrophe again is quite high", he added.

Bernanke is likely to sound "cautiously upbeat on growth and inflation" in his congressional testimony and focus on the "exit" strategy for the radical measures introduced to haul the world's largest economy from recession, said Mr Fabio Fois, an economist at Barclays Capital. AFP

From TODAY, Monday, 22-Feb-2010

----------

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=65a9fea7-0fc0-4c23-b2e0-594cde013cf4)

0 comments:

Post a Comment