When we finally decided to sell our current flat, with the primary purpose of "cashing-in", in order to have some

money to close out some loans and still have some savings left, my wife took a long time getting the thought to sink in. She vacillated between yes and no, ok and why, what if and what if not, etc., etc. I understand. I didn't go through the same emotional

roller coaster. I'm a man. She's a woman. And women tend to have more chance of getting attached. And a

house that becomes a home is one thing that is sure to forge an emotional attachment to our spouses, especially when they are not working and they put a lot of

energy in beatifying the home.

Cutting it all short, 2 weeks or so later, she settled. But a day or two of waiting for prospect buyers to come, I also found myself experiencing - well, that is what is even more torturous - quite an energy-sapping process: waiting. We did feel that there'd be nobody coming to even view the flat, much less to buy it!

Our agent was on the opposite pole, and she was quite confident of closing a deal, and doing the sale. We engaged her service last day of April, and she made it a point that by end of the next month, which is May, the resale is a closed and done deal. That’s what she said.

We talked about the schedule of the flat viewing; evening is ok, and even on some late night schedules, we agreed – if the buyer is serious. You see, she explained that it is not always the one who bids the highest who will end up as the final buyer who will close the deal with you. Not even at a time when the competition is so fierce, where the

law of

Supply and Demand* is very prevalent and very much in effect – both sides. Buyers tend to offer higher than the LO+ so that the Seller usually asks for a sky-high COV+. If many buyers would like to buy your flat, they would naturally offer more, and the COV goes higher and higher. Sounds good, right?

Wrong!

There is usually a paper that will be signed by both parties to initiate the resale, and it is called The Option. It carries a provision to lock-in the pre-supposed sale within 14 days, so that both Seller and Buyer cannot engage in any other transactions. It is legal and binding, and breaches will be legally dealt with. So what now? You see, at the end of the day, the one who shells out a thousand dollar and signs the Option form is not always the one who will finalize the flat resale. People can get pumped up and excited when in a heated bidding state, and what usually happens is that when they come home, cool down and realize what they’ve done, they’d simply let the grand be forfeited, instead of ‘really coughing up’ the very high COV. That is the point that our agent is always making. And, even they they do finalize the flat resale, they’re no longer happy – right from the start.

That is one very good lesson that I have learned from our flat resale.

She’s right. She has the right confidence, and she has the right motivation. She always talk about selling the flat at a ‘reasonable’ price, to the party who ‘needs a roof’ over their head – which usually means a lower COV, but a happier experience for both

seller and buyer.

I agree.

For if there would come prospective buyers, and one who has more money bids higher than the one who needs the flat, and as in the case mentioned above where they don’t exercise their option and don’t finalize the resale, you end up:

- Getting a thousand dollars for free (since buyer didn’t exercise option to purchase, the initial deposit is forfeited. Indicated in the guideline)

- Losing 14 days in the process

- Losing ‘real’ buyers

Our flat value has increased by $100k in a matter of 2 years, and since we didn’t need any renovation when we moved in, we saved a lot then. What’s more, we were able to occupy the flat prior to the resale process completion date. Mid Nov 2007, we submitted the resale application, mid Dec 2007, the owner already gave us the key to the flat – 3 months prior to the resale completion date. These past events helped us to decide to do the same good deed done to us.

In all, there were only 3 batches of buyers who came and viewed our flat: 15-May team, 22-May team, and 23-May team. We have a 3-bedroom flat, but one

common room was hacked and merged with the

master bedroom, in effect making ours a 2-bedroom flat, 1 common room and a master bedroom becoming a huge bedroom with its walk-in wardrobe and air-con unit and all, very suitable for a young couple (as were the previous owners) and couples having small kids. Currently, we have 3 queen-size beds in the master bedroom, where we all sleep, and the common room is the study room for the kids. If you are the type of parent who’d wake up several times during the night and check on your kids, especially when they are infirm and you’d have to monitor their

temperature or wake them up for their medication, this bedroom size and build is very suitable for you. It is for us. It was - then.

The kids are growing, and they would need a room of their own. This is another factor which we considered in the selling of our current flat: to buy a flat with 3 bedrooms, at least. And in the process, we’d have to pass down the flat to a couple or a family that had the same need as us – back then.

So true enough, the tradition lives on. From the 3rd batch was a young couple, starting off, and just like us in many ways: just been PRed+, much around our age back then, and for their case, will be marrying (ceremonially) at about the time the resale’s completion date is scheduled. So it is just right for them to have a flat of their own, to entertain friends, relatives and guests in. They came around 3pm 16-June Sunday, and returned 6.30pm to ink the deal. We’re not sure if they’ve seen other flats, but the even stricter and harder ruling makes you think fast and deal quick. That’s what they did.

And while they didn’t measure up to what we were asking (we’re not making a killing here), they did make a reasonable offer. We thought, we’re not going to be rich with that amount, but we counted our blessings, and with a little more hesitation and haggling, we settled down. While COV figures are rising up to about $58k in our area, we settled with $26k. No, it’s not heroic or modesty. The good deed that was done to us, we are simply paying it forward. We are continuing the tradition. As I said to the young couple, “This is a house of beginnings.” And they got the idea, and we all laughed.

What amused me is that during the time we were negotiating the price, they were staying by the kitchen, beside the toilet, while we were at the

living room. Quite an odd team, the couple and their agent, I mused. But look at the pictures, and you’d understand why they weren’t fussy a bit standing around that area. As what our agent said, "4 kids and a big flat, ‘Your wife is a super girl!’"

Our 8-month old baby was helping out in the selling process. She’s actually making a fuss whenever there are people coming and she’s kept inside. So what happened is that we brought her out, put her in her crib in the living room, and she was ‘entertaining’ the guests. She did so all the while there are buyers coming. Or whenever the agent is around the house. Or when an inspector is checking our flat. Quite a trait for a baby, my wife said. She knows how to entertain people.

Our flat is now sold. Resale application has been submitted. First appointment date is marked. Flat inspection is done, and we are clear to proceed. The huge work is up: packing our things and getting ready for the big move.

But before that, we’d have to pick our new flat, and this time, we will be the buyers. May the good deed done return a hundredfold.

Amen!

-----

* The Law of Supply and Demand, in my connotation here, is this: ‘He who supplies makes the demands.’

+ LO stands for Last Offer, where buyers offer a sum when negotiating to purchase the flat. This is referred to as the Cash-Over-Value amount. And usually, the LO is an amount that the Seller didn't agree to. So would-be buyers will check on the LO, and if they are thinking of offering less, they don't proceed, but if more, they go in right ahead. And the Value is the ‘true value’ of the flat being sold, as determined by an independent, third-party valuer authorized by the government body handling matters about public flats. Nonetheless, since the valuer is a person, the Value figure becomes a subjective matter, but not much. How much difference, I should say around $10k.

+ PR means permanent resident, which is quite a similar term in many countries in the world. You are a foreigner, and if you like to staying in the country, you apply for residency. PR status is halfway between a foreigner and a citizen. You have the choice of applying for a citizenship, or revoking your residency altogether. It’s all your own choice.

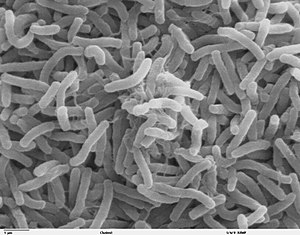

Image via WikipediaThis is needing no other comments than the news article itself...

Image via WikipediaThis is needing no other comments than the news article itself...

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=82d7b426-ec90-4489-8d90-a33465eccab4)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=21babd45-e870-46a7-9b7d-fa0835665cef)